H

Happy

is the

new rich

Helping you live your happiest financial life possible

H

The HOW

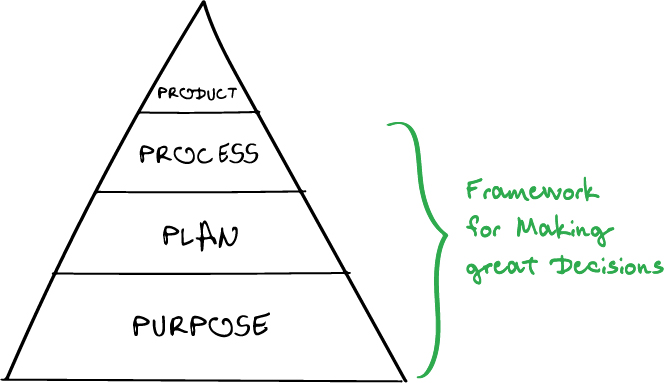

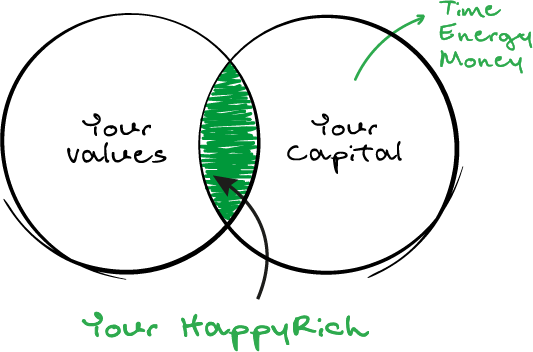

Real Financial Life Planning is about helping people align their use of capital with what’s important to them. This is almost never done. Instead, people focus on picking the best investment before coming up with a financial life plan. This is like trying to decide whether to take a plane, train, or automobile on a trip before you have decided where and more importantly, WHY you want to go.

The WHAT

A clear focus on what your money is really being managed for, aligning actions with your values, and incorporating your values in your financial life is a process which provokes deep and thoughtful responses to understand what’s at your heart’s core.

O

The outcome

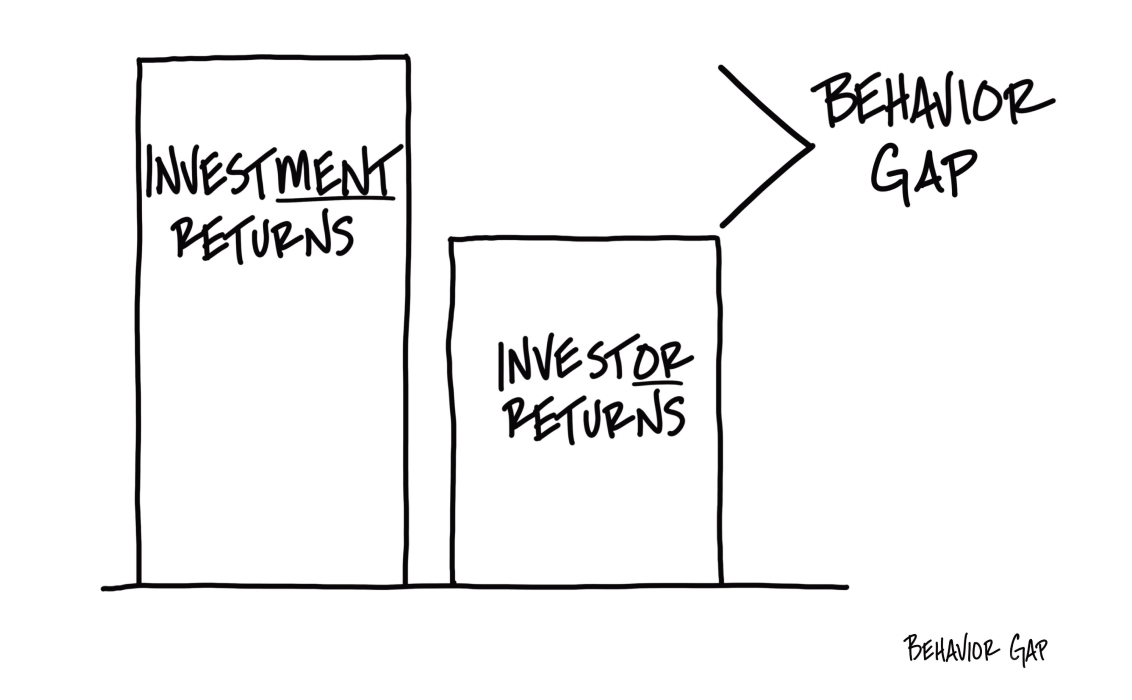

Address Your Behavior Gap

Beat Lifestyle Inflation

Maintain Multi-Generational Wealth

Leave A Legacy

behavior gap

There’s a difference between investment returns and investor returns... and only one of them matters. If a mutual fund yields 10% a year for 10 years, that’s the investment return.

The only way you’re getting that 10% a year for 10 years is if you don’t touch that investment for the whole 10 years. No adding, no subtracting. Buy it and leave it. The problem is, very few people invest that way. On average, we only hold long-term investments for two to three years, and then we get distracted and buy the next hot investment. Investors almost never earn the same return as investments because we don’t hold on to the investments long enough.

The return happens... we just aren’t there to get it and we only have our own behavior to blame.

The repeated habit of buying high and selling low is the culprit behind investment returns and investor returns, and there’s a name for it: The Behavior Gap.

Am I doing okay?

What happens to my family if something happens to me?

Do I have enough? How much is enough?

Am I on track? What do I need to do to get on track?

How do I maintain multi-generational wealth?

What kind of legacy can I create?

What are the risks that I might not be aware of today?

Answer your Expensive Questions

Be your guide in a Changing Landscape

Get between you and Your Costly Mistakes

A Focus

On People Of Indian Origin

Indian Families in the US have an added level of complexity. They have assets in the US and India. Additionally, they are likely to inherit assets in India. Thus, they have to deal with tax, legal, and financial professionals in the US and India both.

All of these are different people and thus a Head of Family end up interacting with 6+ firms all of whom don't talk to each other (as they are not skilled across jurisdictions).

This level of complexity is a key problem for Indian Families in the US, as interacting with so many professionals is time consuming, painful, and expensive.

Secondly, there is no integration between the advice given by these 6+ different professionals. Third, you are expected to provide answers to many of these professionals (as they do not understand the nuances of cross border requirements and specific situations). This creates a clear scope for errors, costly mistakes and thus consequences.

To address these pain points, we have created an offering specifically for Indian families living in the US.

T

Thought leadership

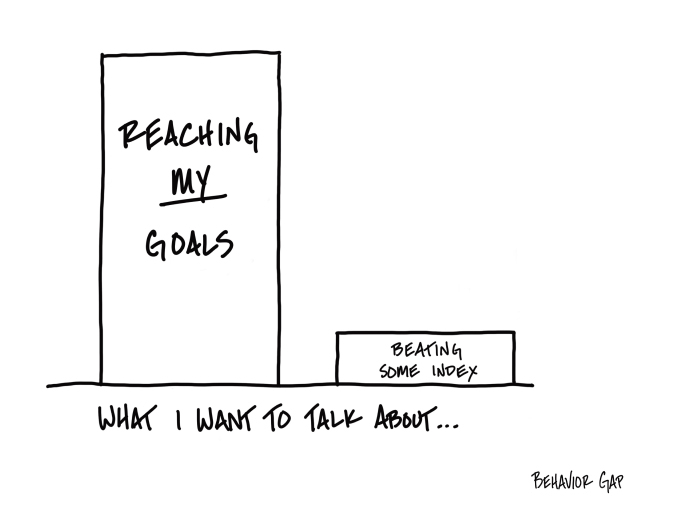

Beating the index

Beating the index

When it comes to personal finance, what matters is not beating some index. What matters is meeting your goals.

An index, of course, is just a broad measure of how a particular market has done. Think of it as the average. The investment industry seems to think that their entire purpose in life is to convince you that the best thing you could ever do is hire someone to help you beat an index.

Whether that’s even possible is debatable, but let’s just focus on why it doesn’t even matter.

PRETEND YOU LIVE IN SOME MAGIC FANTASY WORLD WHERE ALL OF YOUR DREAMS (ACCORDING TO THE INVESTMENT INDUSTRY) COME TRUE, AND YOU ACTUALLY BEAT AN INDEX EVERY QUARTER FOR YOUR WHOLE LIFE. I HATE TO BURST YOUR BUBBLE, BUT IT’S COMPLETELY POSSIBLE—EVEN IN THAT UNLIKELY SCENARIO—THAT YOU DON’T MEET ANY OF YOUR FINANCIAL GOALS.

Why? Because beating an index has nothing to do with meeting your personal financial goals! That has everything to do with careful financial planning.

Now let’s flip that scenario on its head. You slightly underperform the index every quarter for your whole life. But because of careful financial planning, you meet every one of your financial goals.

Doesn’t that sound a heck of a lot better?

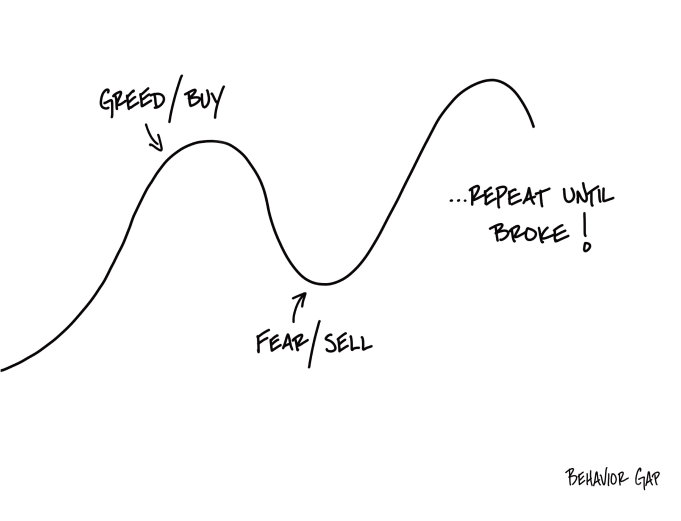

Fear and greed

Fear and greed

Most of us make the same mistake with our money over and over: we buy high out of greed and sell low out of fear. Just look at mutual funds. At the top of the market, we can’t buy fast enough. At the bottom, we can’t sell fast enough. And we repeat that over and over until we’re broke.

Can you imagine doing this in any other setting? Imagine walking into an Audi dealership and saying, “I need a new A6.” The salesperson says, “Oh my gosh, you’re in luck, we just marked them up 30%.” And you say, “Awesome, I’ll take three!” Look, I get it.

We’re hardwired to get more of what gives us security and pleasure, and run away as fast as we can from things that cause pain. That behavior has kept us alive as a species. Mix that with our desire to be in the herd, the feeling that there’s safety in numbers, and you get a pretty potent cocktail.

WHEN EVERYONE ELSE IS BUYING, IT FEELS LIKE IF WE DON’T JOIN THEM, WE’RE GOING TO GET EATEN BY THE FINANCIAL VERSION OF A SABER-TOOTHED TIGER.

But it doesn’t take a genius (or Warren Buffett) to see that this behavior is terrible for us when it comes to investing.

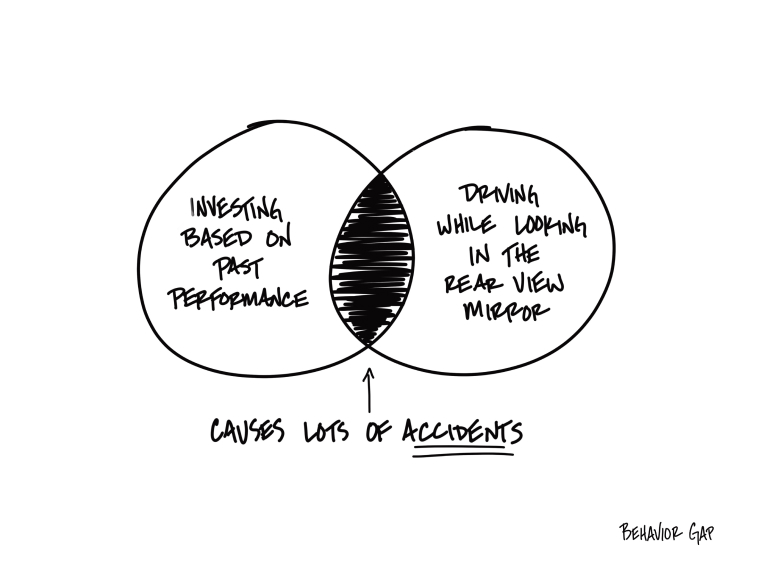

Rear View Mirror

Rear View Mirror

INVESTING BASED ON PAST PERFORMANCE IS LIKE DRIVING WHILE LOOKING IN THE REAR VIEW MIRROR. IT. WILL. CAUSE. ACCIDENTS.

Now, I know we’ve all heard the disclaimer repeated on every single investment advertisement: “Past performance is no indication of future results.” We hear it often enough. We might even believe it.

But then… what’s the first thing we do when we have a pool of money to invest?

In fact, what feels like the right thing to do?

No prizes for guessing, because you know the answer. The first thing we do when we have money to invest is look for the investment that has recently done well. AKA, past performance.

Look, I get it. It feels like that makes sense. If you’re going to hire a contractor to remodel your kitchen, it would be reasonable to go look at the work they’ve done in the past and to expect that quality of work to continue, if not improve. But when it comes to investing, this does not hold up. Because investments go in cycles, looking at how things have done in the recent past leads us to buy high, which inevitably leads us to be disappointed, and then we sell low. And we repeat the process over and over and over.

Driving while looking in the rear view mirror doesn’t make sense. Neither does investing based on the past.

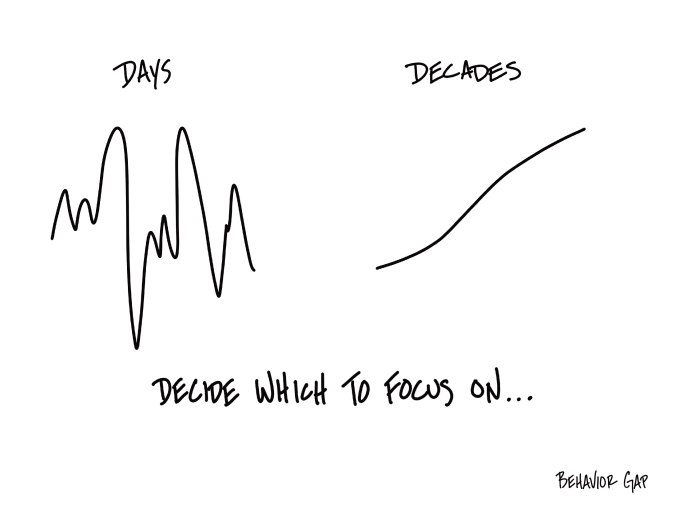

Days Or Decades

Days Or Decades

What I’m about to tell you is going to sound crazy, but bear with me.

Because it’s definitely true.

Ready? Here it is…

We get to decide what we focus on.

Hold on… let me repeat that in case you missed it.

We. Get. To. Decide. What. We. Focus. On.

When it comes to investing, that means you have a choice. You can focus on days or decades.

If you choose to focus on days, you are signing up to make yourself miserable. And for no good reason. There’s actually no benefit to this perspective. I can handle pain that leads to gain, but this is just pain that leads to more pain.

ON THE OTHER HAND, WHEN IT COMES TO INVESTING, WE ACTUALLY GET REWARDED FOR IGNORING THE DAILY NOISE. AS WARREN BUFFETT SAID, “BENIGN NEGLECT, BORDERING ON SLOTH, REMAINS THE HALLMARK OF OUR INVESTMENT PROCESS.”

Remember, you actually have a choice.

Days or decades.

What’s it going to be?

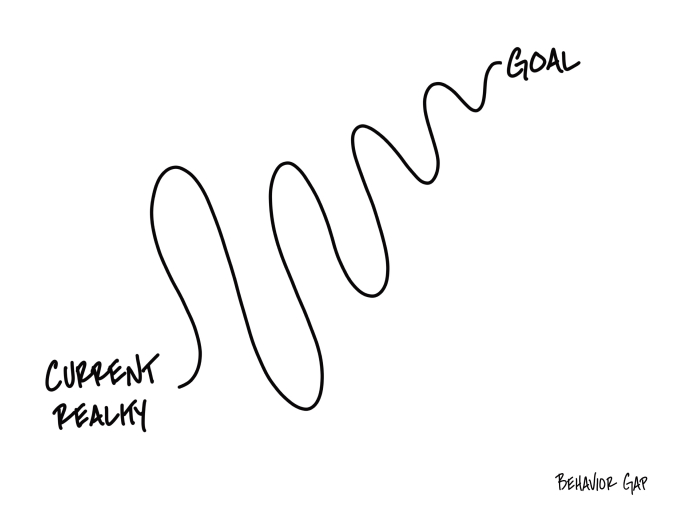

Less Wrong Tomorrow

Less Wrong Tomorrow

Real Financial Planning is not about being right today, it’s about being less wrong tomorrow. Airline pilots know this. For years, every time I met one, I would ask two questions. The first was, “Do you prepare a flight plan for every single flight?” And every pilot I asked answered “Yes.” The second was, “How often does the flight go exactly as you planned?” To which they always answered “Never.”

This should come as no surprise. The flight always differs from the plan because life is unpredictable, and no matter how hard we try, we never have all the information we need about the future before we start. Think about what we are trying to do when we create a financial plan that might span 30 years or more. We have to guess about rates of return, inflation, taxes, goals, a date of death, and on and on. There is no way to get that 100% right.

IN FACT, THE ONLY THING WE KNOW FOR SURE ABOUT ANY GOOD FINANCIAL PLAN THE MOMENT WE FINISH DESIGNING IT IS THAT IT’S WRONG. WE JUST DON’T KNOW EXACTLY HOW, YET.

So instead of being worried about getting everything right, we do the best we can to create a plan, and then we accept the reality that financial plans are worthless without the ongoing process of planning. It’s the course corrections over time that allow us to narrow in the potential range of outcomes and reach our goal. Real Financial Planning is a process, not an event.

Money = feelings

Money = feelings

Talking about money is like grabbing an electric fence you didn’t know was electric. In other words, shocking. And not very pleasant.

We’ve been taught, if we were taught anything about money, that it’s about spreadsheets and calculators. It should be rational and reasonable. But then we go to open the AmEx bill with our spouse or partner, and suddenly, we find ourselves in a fight.

IF MONEY IS ALL ABOUT SPREADSHEETS, HOW DOES GREED FIT IN A SPREADSHEET? HOW ABOUT FEAR? HOW ABOUT THE CONCERN THAT YOU’RE NOT GOING TO BE ABLE TO PROVIDE THE LIFE FOR YOUR KIDS THAT YOU HOPED?

We all know that no matter how worried, scared, or excited we’re feeling, 2+2 always equals 4. But when it comes to money, 2+2 equals all kinds of emotions—like fear, greed, insecurity, pride, and more.

The sooner we realize this is true, the sooner we can begin having realistic expectations around what it’s like to talk about money. Look, I get it. Talking about money is hard. But just because it’s hard doesn’t mean we should avoid it. In fact, as is often the case with difficult things, talking about money can actually be very fulfilling once you learn to do it correctly. The first step, though, is simply to acknowledge what the conversation is about.

Money ≠ Math.

Money = Feelings.